Frequently Asked Questions (FAQ)

FAQ Site Map

General

- How to contact Insight Prediction?

- What is Insight Prediction

- How Does Insight Prediction Work?

- Where is Insight Prediction Based

- What am I trading?

- What are the fees?

- How do taker fees work?

Depositing and Withdrawing Funds

- How to deposit?

- What is the best Crypto to deposit with?

- Do I need to deposit stablecoins?

- What cryptocurrencies does Insight Prediction accept?

- Recommended Exchanges

- My deposit has not arrived. What should I do?

How to Trade

Rules/Market Resolution

- When does a market close?

- How long does it take a market to resolve after the event has happened?

- What is the review process if I believe a market has resolved incorrectly?

- How are sports markets where there is a cancellation or 'Technical Draw' in MMA resolved?

- What is this "Bet Locks" withdrawal feature? Why are my bets being returned?

- How do you use price alerts? What does this do?

General

How to Contact Insight Prediction?

First, you can email support at support@insightprediction.com. You can also visit our Discord and ask questions or leave feedback there.

What is Insight Prediction?

Insight Prediction is a prediction market platform which enables users to trade on future events including elections, sports, and Covid-19 policy. Prediction markets have been proven to be one of the best ways of forecasting future events. When users trade on events such as “Covid-19 case counts” publicly useful information is aggregated and priced. We are dedicated to building the best possible platform to improve forecasting and empower traders.

How Does Insight Prediction Work?

Users deposit funds in the form of cryptocurrency, stablecoins, which we then immediately convert to dollars at no cost to the users. Users can then trade on various events in dollars. We'll have some markets denominated in other currencies. Insight Prediction markets are in the form of binary option contracts. These contracts are each based around a “Yes” or “No” question about a future event (example: Will Trump win the election?). Each “Yes” or “No” contract has a price between .1 cents and 99.9 cents and an end date when the market is resolved. When the end date is reached, the outcome of a market is determined as either “Yes” or “No”. If the answer to the market is determined as “Yes” each “Yes” contract will pay out $1.00 and each “No” contract will pay out $0 and vice versa. To learn more about binary option contracts click here.

Where Is Insight Prediction Based?

Insight Prediction is headquartered in the United States of America and incorporated as Marion Research, Inc. in Delaware, and run by Americans.

What Am I trading?

Insight Prediction allows you to trade contracts which range between .1 and 99.9 cents in price. These prices reflect the market’s estimate of the probability of an event taking place.

The value of these contracts fluctuates over time reflecting the beliefs of users as they trade. You can offer to sell your contracts at any point before the markets resolve. If your shares have gone up in value, you may decide to sell in order to guarantee profits or if your shares go down in value you may decide to sell in order to prevent further loss. Alternatively, you can hold onto your shares until the market resolves. At that point, if the event in the market has taken place, Insight Prediction will value ‘Yes’ shares at $1 and ‘No” shares at $0. If it has not, ‘No’ contracts will be valued at $1 while ‘Yes’ contracts will go to $0.

What Are the fees?

Fees at Insight Prediction can depend on the event, and we reserve the right to change the fee structure for new markets at any time. For some policy-relevant markets, Insight Prediction plans to collect no fees at all! As of August 2022, all new markets at Insight Prediction will feature a "maker" subsidy and a "taker" fee. The maker subsidy will be equal to 2.5% of the product of your cost basis times potential profits. Note that a "maker subsidy" applies when you place an order that is not immediately matching an existing order on the order book. If, instead, you place an order that matches a pre-existing order, then you are a "taker". The taker fees are set to 7.5% of product of the price times the potential profit. Thus, the fees and subsidies are computed as: Maker Subsidy = .025*Price/100*(1-Price/100) & Taker Fee = X*Price/100*(1-Price/100). This means that when buying a share at 50 cents, you would receive about 1.25% of your cost basis in the form of a subsidy, and as a taker, you would pay about 3.75% of your cost basis, or 3.75% of potential profits, in fees. If you bought at 99 cents, you would receive a very small subsidy as a percentage of cost, but close to 2.5% of your potential profits (and you would pay close to 7.5% of potential profits in fees if you were a taker). All fees will be expressly noted in the 'Rules' section of the market. Note that after May 26th, 2022 to the end of July, we charged taker fees of 7.5% of prices times potential profits, and no maker fees. Before that, our fees were set to 3% of profits.

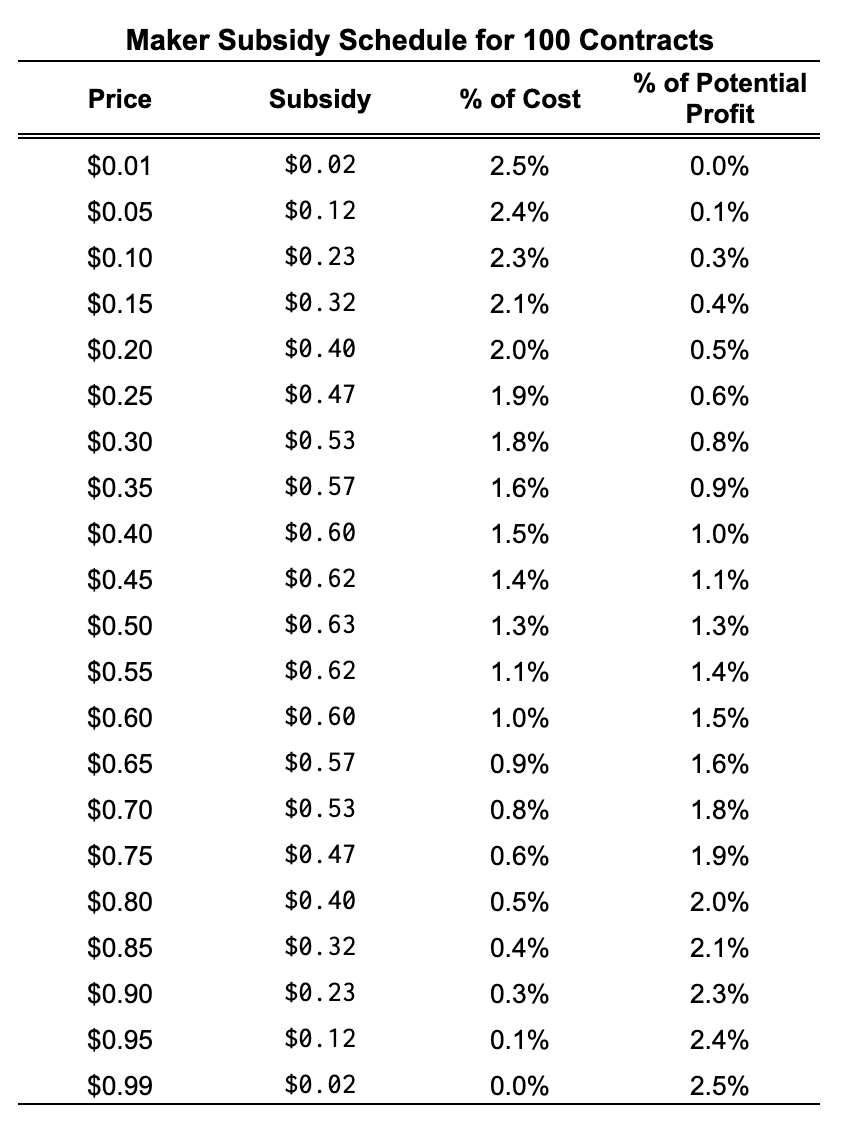

What Are the Maker Subsidy & Taker Fee Schedules?

Our standard maker subsidies through October 2023 are computed as 2.5% of the price times potential profits: Maker Subsidy = .025*Price/100*(1-Price/100), where the price here is in cents. From November 2023 we are doubling the maker subsidy on new markets to encourage liquidity providing. (Note: maker subsidies are awarded when you create an order that is not instantaneously matched. For example, if the best ask price is 10 cents, and you put in an order to buy at 9 cents, your order would then be placed on the order book to be matched later, and thus would be a "maker" order.) Here is the table for how our taker fees work out for 100 contracts at various prices, rounded to the cent.

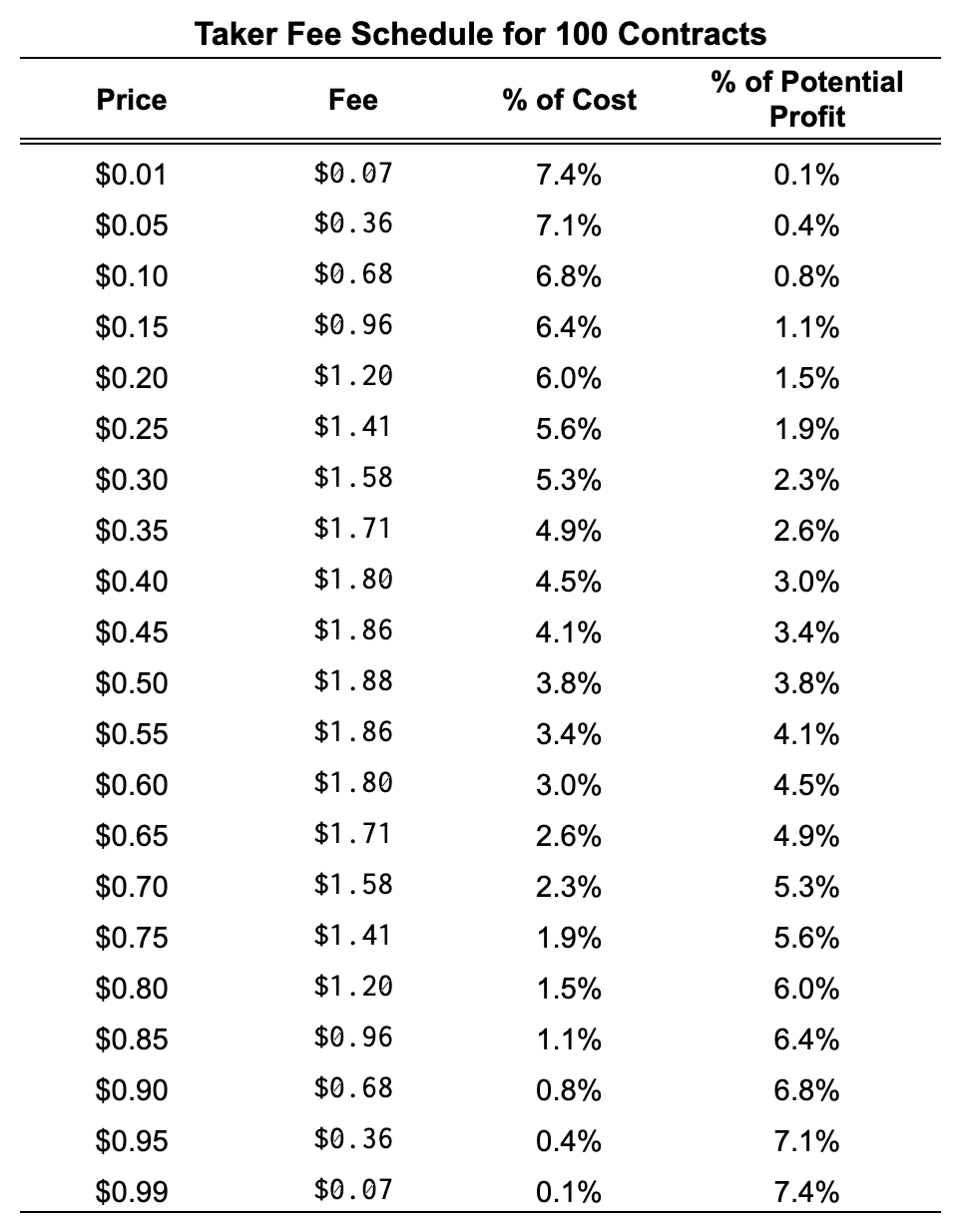

Our standard taker fees are computed as 7.5% of the price times potential profits: Taker Fee = .075*Price/100*(1-Price/100), where the price here is in cents. (Note: taker fees are assessed when you match an existing order on the order books.) Here is the table for how our taker fees work out for 100 contracts at various prices, rounded to the cent. Note that from November 2023, on new markets we are increasing both the maker subsidies and taker fees, to .1*Price/100*(1-Price/100).

Depositing and Withdrawing Funds

How to Deposit

Note that sending and receiving on polygon is temporily disabled until September 10th, 2024.

We offer our users several methods to deposit. The easiest and fastest method is via a regulated stablecoin: USDC (Polygon/Matic). We can also handle deposits via PayPal, or wire transfers for amounts over $1,000 (enquire for details: support@insightprediction.com). The stablecoins with low gas fees we accept currently is USDC (Polygon/Matic), but we also accept USDC (ERC20) which tends to have high gas fees (several dollars per transaction). Note, if you wish to participate in our BTC or ETH markets (currently, only a few), you'll have to deposit in these currencies. Note that as of right now (10/25/2023), you cannot transfer funds from ETH/BTC to USDC automatically. However, we can make these transfers manually on a case-by-case basis (email support@insightprediction.com, and say that you would like to change your crypto to dollars; we will sell your crypto at the market rate and deduct fees).

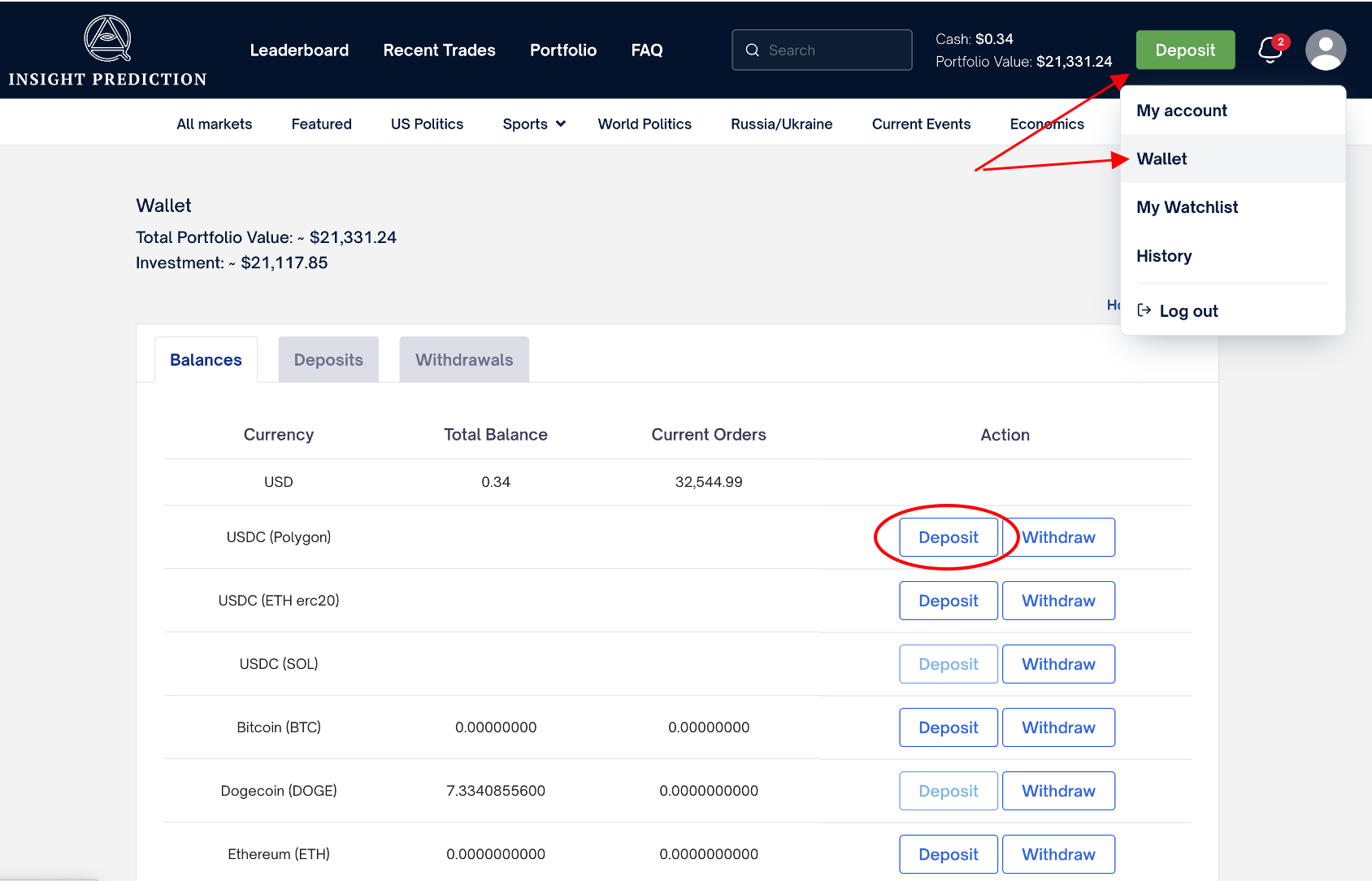

To deposit funds:

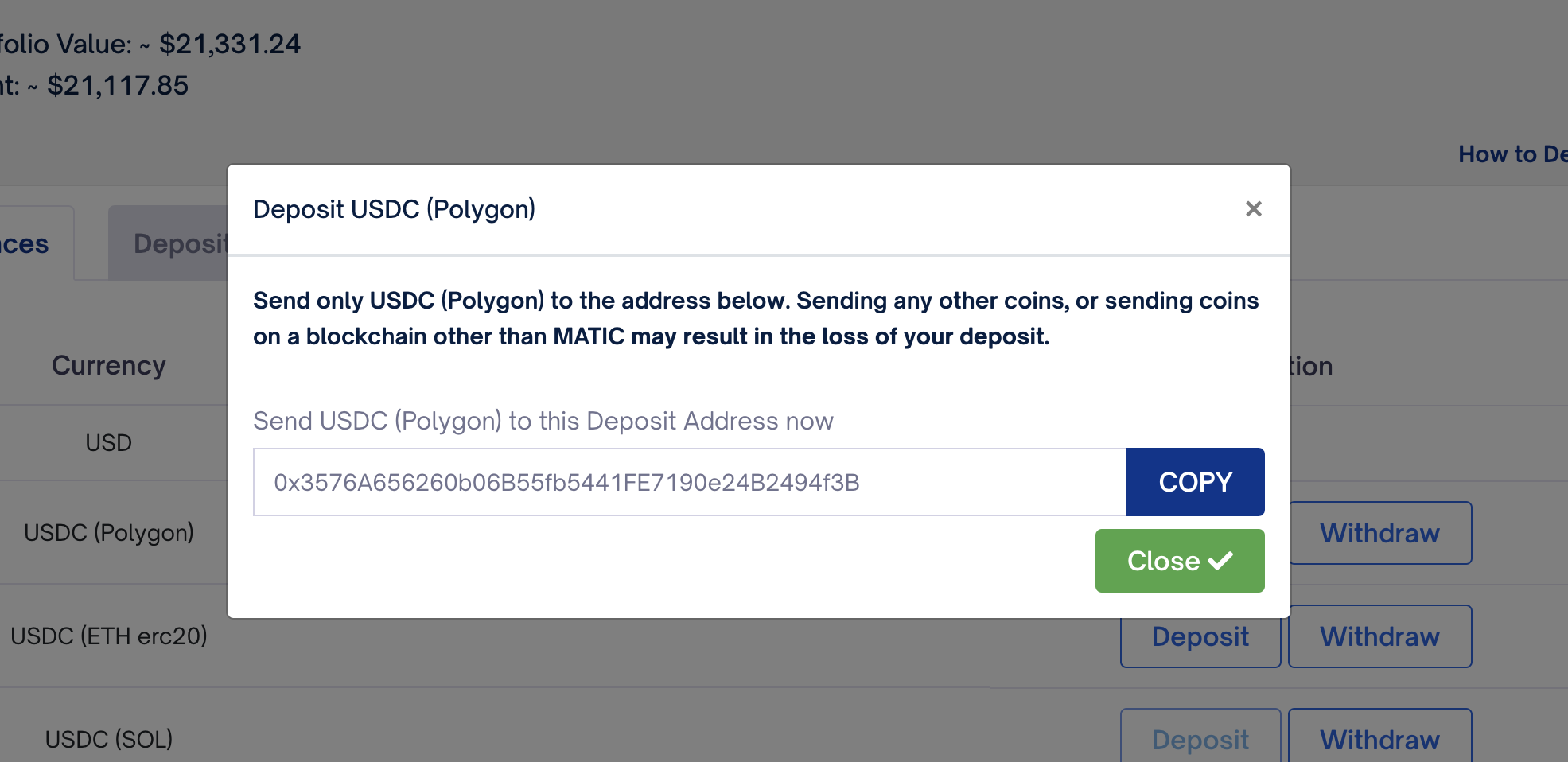

1. Find the Deposit button of the crypto and network you wish to use on your “Wallet” page. We recommend USDC (polygon).

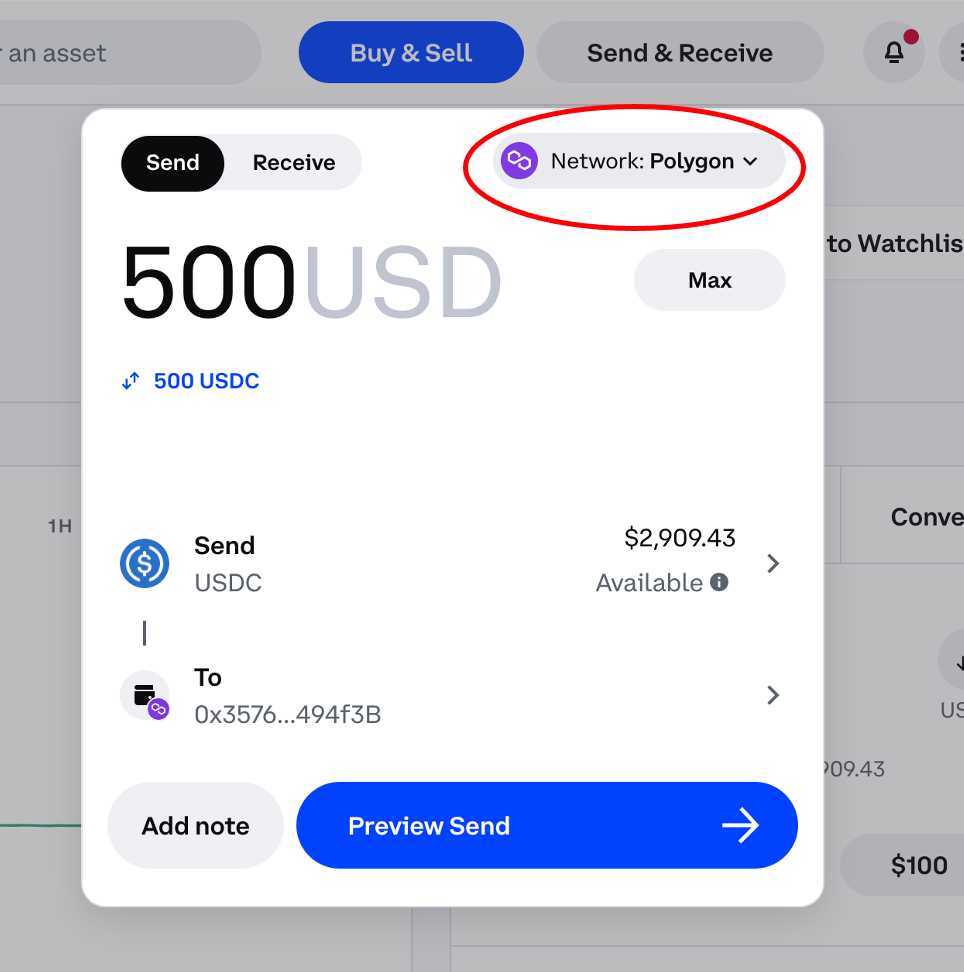

2. Copy the wallet address. Be sure to send USDC (or whichever crypto you select) on the same chain, or your funds may be lost. If you select polygon (also called matic), then be sure to send USDC on the polygon chain.

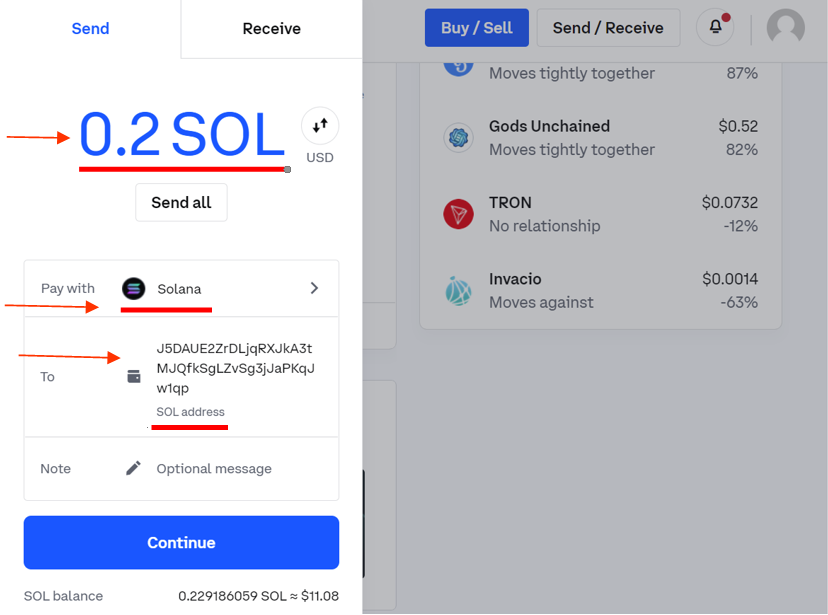

3. Next, go to your preferred crypto exchange, and click “Send” or “Withdraw”. Then paste your Insight Prediction Wallet address into the address tab, choose USDC, and the polygon chain (if sending on polygon), and send the funds. Your exchange migh require 2-factor authentification.

Here is how this looks currently on Coinbase, for example:

4. Once you have sent the funds, they should appear in your Insight Prediction Wallet within a couple of minutes. You can re-use the same wallet address in the future.

What Is the Best Crypto to Deposit with?

Deposits are subject to variable network (gas) fees. These fees fluctuate based on network traffic at the time of deposit.

In order to avoid high gas fees, we recommend that you use Polygon/matic. Fees tend to be much less than one dollar per transaction. Fees using the ethereum chain can often be several dollars.

Do I Need to Deposit Stablecoins?

Yes. Insight Prediction accepts both stablecoins and other cryptocurrencies. When depositing stable coins, your dollar account will automatically be credited the value of your deposit. The currency in most of our markets is in dollars, not in USDC.

If you wish to trade in our BTC or ETH markets, then you will need to deposit in those coins.

What cryptocurrencies does Insight Prediction accept?

Stablecoins:

USDC (Polygon), USDC (ERC20). In the future, we may also accept USDC (SOL), but for now you can only withdrawal on solana.

Cryptocurrencies:

Bitcoin (BTC), Ethereum (ETH)

Recommended Exchanges:

Coinbase/Coinbase Pro

Cheapest: USDC (Polygon), Solana (SOL)

Supports: USDC (Polygon), USDC (ERC20), Bitcoin (BTC), Solana (SOL), Dogecoin (DOGE), Ethereum (ETH), Litecoin (LTC)

Paypal.com

Cheapest: USDC (Polygon), Solana (SOL)

Supports: USDC (Polygon), USDC (ERC20), Bitcoin (BTC), Solana (SOL), Dogecoin (DOGE), Ethereum (ETH), Litecoin (LTC)

Crypto.com

Cheapest: USDC (Polygon), USDC (SOL)

Supports: USDC (ERC20), Bitcoin (BTC), Solana (SOL), Dogecoin (DOGE), Ethereum (ETH), Litecoin (LTC)

Other Compatible Exchanges:

Gemini

Cheapest: Solana (SOL)

Supports: USDC (ERC20), Bitcoin (BTC), Solana (SOL), Dogecoin (DOGE), Ethereum (ETH), Litecoin (LTC)

Kraken

Cheapest: Solana (SOL)

Supports: USDC (ERC20), Bitcoin (BTC), Solana (SOL), Dogecoin (DOGE), Ethereum (ETH), Litecoin (LTC)

Binance

Cheapest: BUSD (BSC)

Supports: USDC (ERC20), Bitcoin (BTC), Solana (SOL), Dogecoin (DOGE), Ethereum (ETH), Litecoin (LTC)

MEXC.com

Cheapest: Solana (SOL)

Supports: USDC (Polygon), USDC (SOL), USDC (ERC20), Bitcoin (BTC), Solana (SOL), Dogecoin (DOGE), Ethereum (ETH), Litecoin (LTC)

My Deposit Has Not Arrived. What Should I Do?

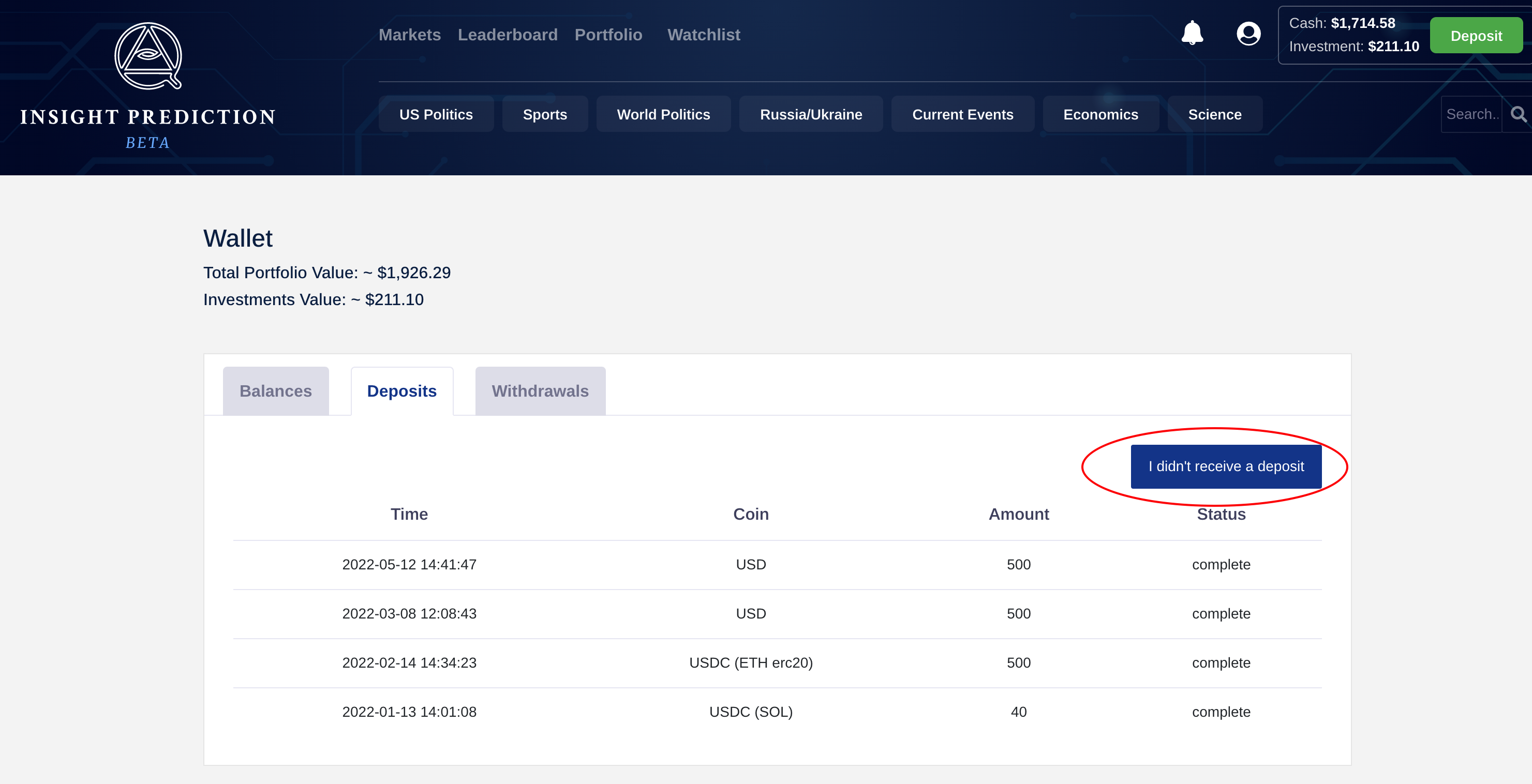

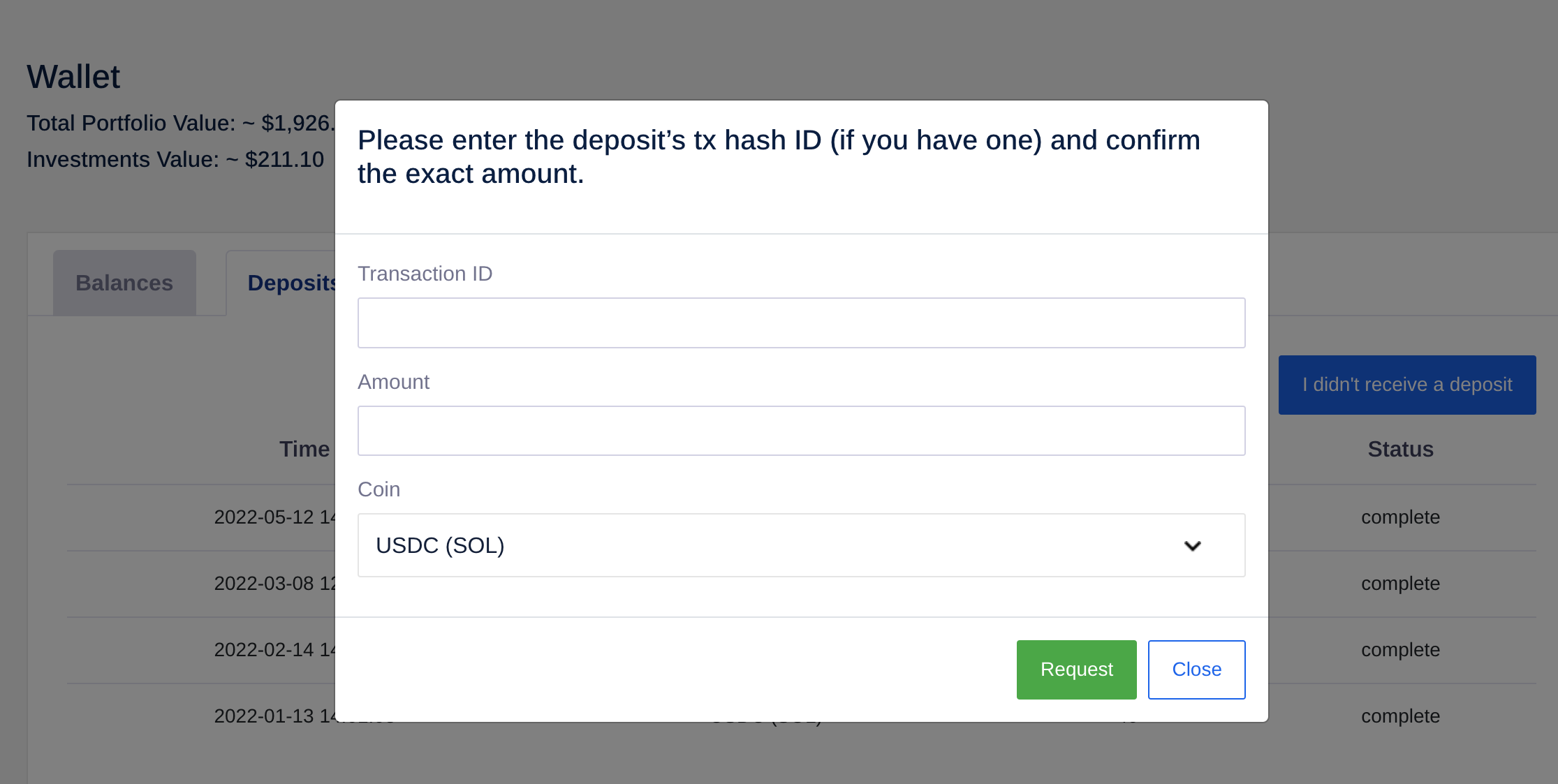

You can navigate to the "Deposits" tab on your wallet to check the status of your deposit. If you did not receive it, you can click on the "I didn't receive a deposit" button.

Then you can enter the amount of your transaction, the coin, and the Transaction ID (from the blockchain you sent, if it is available), and we will look for your transaction. The most common reason that a transaction fails is that someone forgot to confirm their original deposit amount. If so, then entering just the amount and the coin can help. If you also enter the Transaction ID, we can look up and verify your transaction on the blockchain, and then credit your account.

If that does not work, or if you have any problems along the way, then feel free to reach out to us at support@insightprediction.com or ask us questions on our discord: https://discord.gg/Ern9ThVfzs.

How to Trade

How Do I Trade?

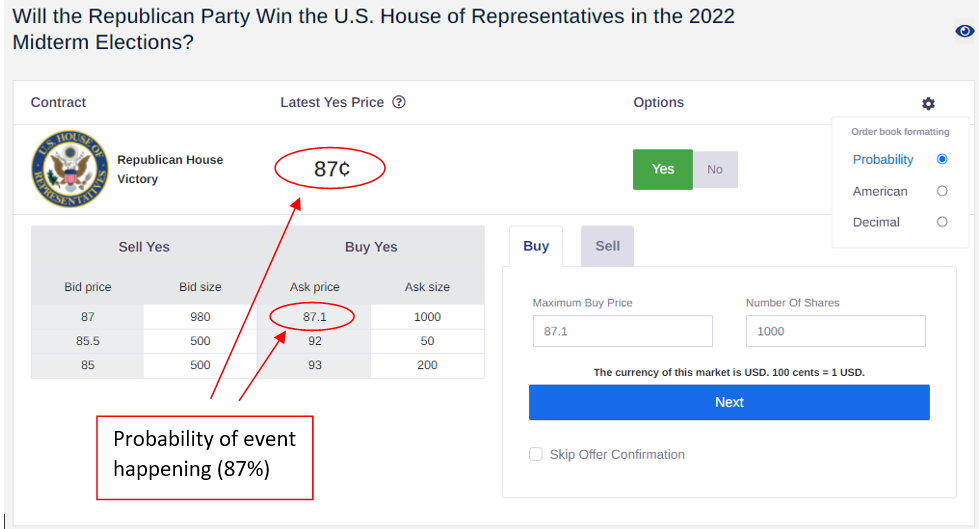

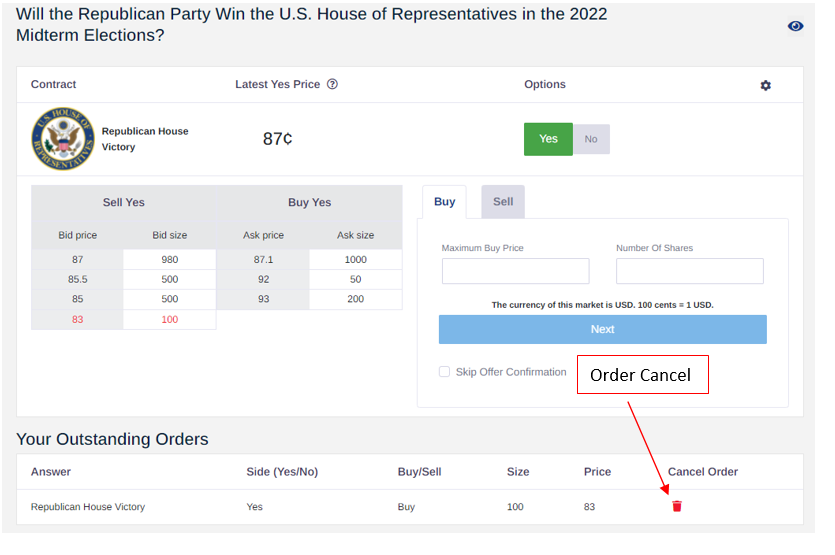

Insight Prediction allows you to trade binary options, contracts which range between .1 and 99.9 cents in price, and pay off one dollar if the conditions are satisfied and zero otherwise. A "Latest Yes Price" of 87¢ indicates that the event has an 87% chance of happening. If you buy one share of a "Yes" contract (in this example, it is if the Republicans win the House in the 2022 midterm elections) at 87¢, and the Republicans win, you will be paid $1.00, with a 13¢ profit (14.9%) before fees.

The value of these contracts fluctuates over time reflecting the beliefs of users as they trade. You can offer to sell your contracts at any point before the markets resolve. Note that if your shares have gone up in value, you may decide to sell in order to guarantee profits. Conversely, if your shares go down in value you may decide to sell in order to prevent further loss. Alternatively, you can hold onto your shares until the market resolves. At that point, if the event in the market has taken place, Insight Prediction will value "Yes" shares at $1 and "No” shares at $0. If it has not, "No" contracts will be valued at $1 while "Yes" contracts will go to $0.

How Do I Use the Order Book?

Insight Prediction uses an order book similar to a stock exchange. Order Books have “Bids” and “Asks”. The term "Bid price" refers to the highest price a buyer will pay to buy a specified number of shares while the term "Ask price" refers to the lowest price at which a seller will sell shares. The “Ask size” refers to the number of shares available to buy, and the "Bid size" refers to the number of shares available to be sold.

If you believe a market is more likely to resolve as “Yes” than the current best ask price then you can trade on this belief by buying shares at the lowest ask price available (87.1¢ in the case above). So, if I thought the Republicans had a greater than 87.1% chance of winning the House of Representatives, I could buy up to 1,000 contracts priced at $0.871 each, at a cost of 1,000*.871 = $871 (shares*price = cost).

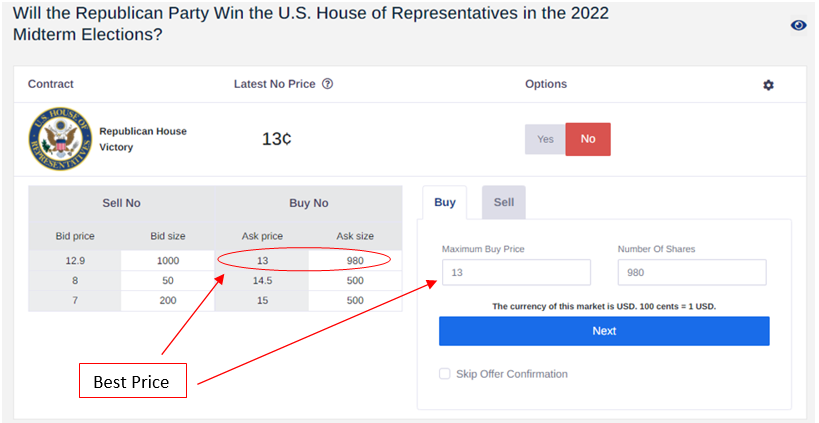

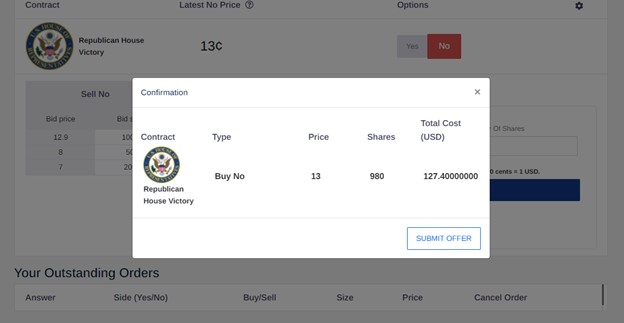

Alternatively, If I thought the Democrats were undervalued at 13%, I would want to buy “No” contracts. To buy “No” contracts simply click the “No” button under options, fill in the lowest ask price and the number of contracts I wanted to purchase and click the "Next" button.

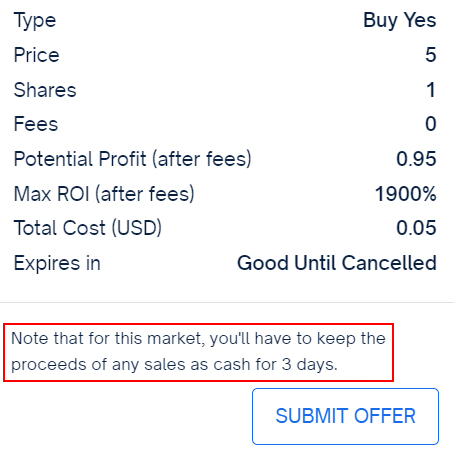

After clicking the blue “Next” button you’ll be shown the number of shares, the price of the shares, and the total cost of the order. To complete the trade simply press the “Submit Offer” button.

How Do I Sell Shares I Have Already Purchased?

If you first buy "Yes" shares, then there are two ways to sell. The first is to click on the "Sell" button to sell your yes shares. Alternatively, you can buy "No" shares, and your yes and no shares will automatically cancel. Conversely, if you first buy "No" shares, you can either sell your "No" shares, or buy "Yes" shares, and they will cancel. Below we show what happens if you try to sell "Yes" shares before you have any: you will get a "You don't have shares to sell" error message.

How to Place a Resting (Or "Maker") Order

If you are interested in buying shares at a lower price than they are currently offered, you can place a resting order at a price of your choice. Let’s say I want to bet that the Republican Party will win the House, but I think that 87% is too high of a probability and I’m only willing to buy at 83%.

I could place a resting order to buy at 83% by filling in the order tab with the price and quantity of my choosing.

After submitting your offer, the Resting-order will be added to the order book and other users will have the opportunity to fill that order if they so choose. The order will show up for you in red in the order book (see below).

Can I Cancel Trades and Orders I Place?

Once a trade is executed, that trade is final and cannot be canceled. Once an order is placed it can be canceled at any point. To cancel an order, go to the market of the page you'd like to cancel an order on (to find which markets you have orders on, you can go to the “My Markets Tab”). All markets in which you have placed an order will appear there. You can then click on the market, scroll down to “Your Outstanding Orders” and click the trashcan icon to cancel.

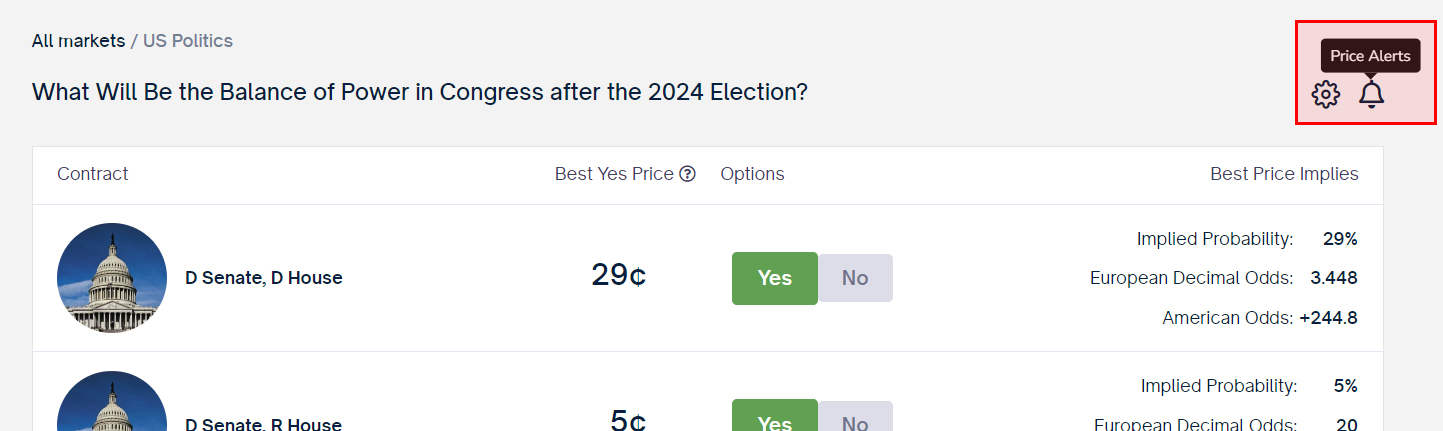

I Am Used to European or American Odds. Is There a Way to Switch?

On our platform, you can toggle between our own "probability" odds, formatted in cents, and European decimal odds, or American odds. Note that the trades themselves, and the latest yes price have to be placed in our own probability odds formatted in cents, but you can view the order book in terms of either European or American odds by clicking the settings button to the right of "Options".

How to Buy and Sell Crypto

Currently, this functionality is not available. If you deposit in BTC, you can only trade in our BTC markets. We plan to restore this functionality soon. If you'd like to sell your BTC for dollars, then email support@insightprediction.com and ask to convert. We will sell at the market price, and pass along exchange fees.

Rules/Market Resolution

When Does a Market Close?

Markets close at the "End Date" listed in the rules of every market. Insight Prediction reserves the right to extend the End Date of a market if the underlying event is postponed. Insight Prediction may also close a market before the ‘End Date’ if the outcome of the market is decided. Insight Prediction maintains sole discretion over when markets resolve and stresses that the “End Date” is subject to change in order to maintain the integrity of the market. Insight Prediction will always strive to resolve markets fairly, according to the specific rules of the market in question.

How Long Does it Take a Market to Resolve After the Event Has Happened?

Insight Prediction recognizes that users prefer payouts as soon as possible after the outcome of a market has been determined. Insight Prediction prioritizes resolving markets as soon as possible without jeopardizing the integrity of our markets. As a general standard, users should expect markets to be resolved within two days of their outcome being determined.

What Is the Review Process if I Believe a Market Has Resolved Incorrectly?

If you believe a market has been resolved incorrectly you can contact us at support@insightprediction.com.

If a market resolution is thought to be contentious, we will typically write a draft resolution clearly explaining our thinking. Then, we will solicit feedback from the community. It might be that many market participants have much more specialized knowledge, and can point out factual errors in our logic. Then, we will consider their points, and come to a final decision. Our goal with the process is to resolve markets as accurately and fairly as possible and with an eye toward avoiding confusion and controversy. That said, there will always be markets that are hotly contested.

How Are Sports Markets Where There Is a Cancellation or 'Technical Draw' in MMA Resolved?

In the case that there is an event cancellation, long postponement, or a "No contest" or "technical draw" in MMA, what will we do? If there are just a few trades, and no one has bought and then sold shares, what we will do is just refund each user's money (Note that if we have props on MMA, such as who won round 1, that can be resolved even in the case there is a technical draw, then we will still resolve it as normal.)

However, if there are many trades, and users have bought and sold shares, perhaps at a profit or loss, we cannot and will not reverse past trades. What we will do in this case is resolve the market at an average of our sport's bots trades. Note that our sports bot tends to be set at an average of bookie odds. So, what this means is that the outcome is set to an average of pre-match odds. Thus, if the bot traded at an average price of 70 cents for the Lakers to win, and the Laker's game is canceled, those who held the Lakers to win will get 70 cents, and those who had the Lakers to lose would get 30 cents.

If a match is delayed by a short amount of time, perhaps by a couple of days, we will not resolve the market but just wait for it to be played. However, if it is rescheduled for months in the future, we will opt for a refund/resolution.

What Is This "Bet Locks" Withdrawal Feature? Why Are My Bets Being Returned?

For certain markets, there is a 72-hour waiting period following share sell orders where you may be unable to withdraw funds that were previously invested in the market. This feature may be enabled on "sudden death" markets where the outcome could be revealed at any time and result in resolution criteria to be met. If this feature is enabled, then any bets placed after such an announcement may be returned to market traders at Insight Prediction's discretion. Markets with the feature enabled will have a notice visible to traders when orders are placed.

For instance, if it is suddenly announced by Elon Musk that he has had another child, then the corresponding market would become resolvable. Any bets placed after announcement would be refunded to traders before the market is resolved. In addition, Bet Locks may also be activated prior to resolution in the event of a court decision, credible statement, or news report that directly leads to resolution or insinuates criteria will be met in the near future (e.g. court ruling that the CFTC cannot force Predict operations to cease, unconfirmed but credible reporting that Musk has had a hidden child). This provides greater protection for liquidity providers against a sudden loss of funds and incentivizes higher-volume trading with a larger liquidity pool.

Note that for sports games and congressional vote margin markets, "Bet Locks" may be applied to trades made any time after the scheduled start time or convening for discussion unless the market specifies otherwise (e.g. "In-Game Trading") in the rules or title of the market.

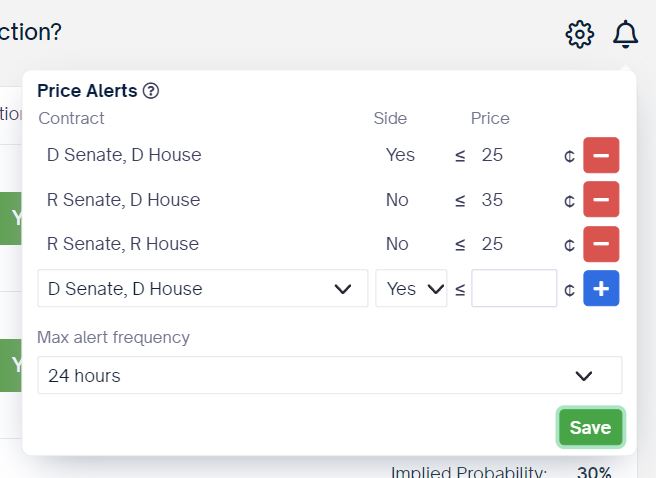

How do you use price alerts? What does this do?

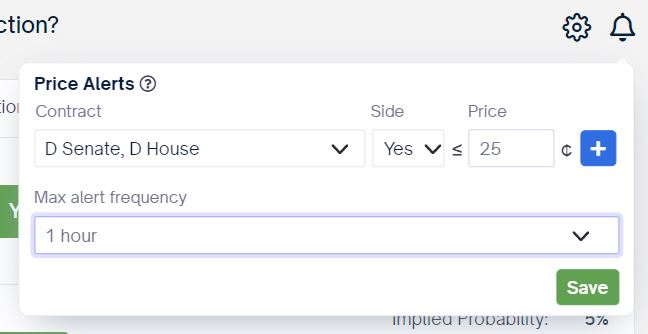

Price Alerts are located at the top-right of every active market page, and can be accessed under the bell icon.

In the Price Alerts menu, you can select the particular contract, side, and price that you would like to be alerted if reached. If a price alert is triggered, you will receive an e-mail notification. In the above example, you will be alerted if any liquidity is added for "D Senate, D House" at or below a price of 25¢. Once you have your price alert configured, you can click the "+" icon to add the alert. You may add multiple alerts for the same market or same contract. In addition, you can set a "Max alert frequency". If new liquidity is added below your last alerted price, you will be sent another e-mail once the specified time period has elapsed.

Once all alerts have been added and settings configured, you can hit "Save" to confirm all changes. You can always return to this menu to add additional alerts, remove previous alerts, or adjust the alert frequency.